AI is moving faster than your strategy. Read more

Dec 22, 2025

3

min

Global climate finance reached $1.9 trillion in 2023, a record that on the surface suggests momentum and progress. Yet beneath this headline figure lies a more uncomfortable truth: developing countries alone will require $2.4 trillion annually by 2030, rising to $3.3 trillion by 2035, to meet climate goals. This is not a marginal shortfall but a structural financing gap that threatens to stall the global energy transition just as climate risks, regulatory pressure, and capital reallocation accelerate.

Public finance, while essential, is fundamentally insufficient to meet this scale. Governments face fiscal constraints, rising debt burdens, and competing social priorities, while climate investment needs continue to compound year after year. At the same time, trillions of dollars in private capital sit on institutional balance sheets searching for long-term, yield-generating opportunities.

The central question, therefore, is no longer whether capital exists, but why it is not flowing at the pace and scale required. Understanding how to unlock, structure, and deploy private capital into climate-aligned assets is rapidly becoming one of the most important challenges, and opportunities, in global finance today. This article explores what is holding capital back, what is already working, and how private finance can be mobilized at scale to close the climate investment gap.

The Reality Check

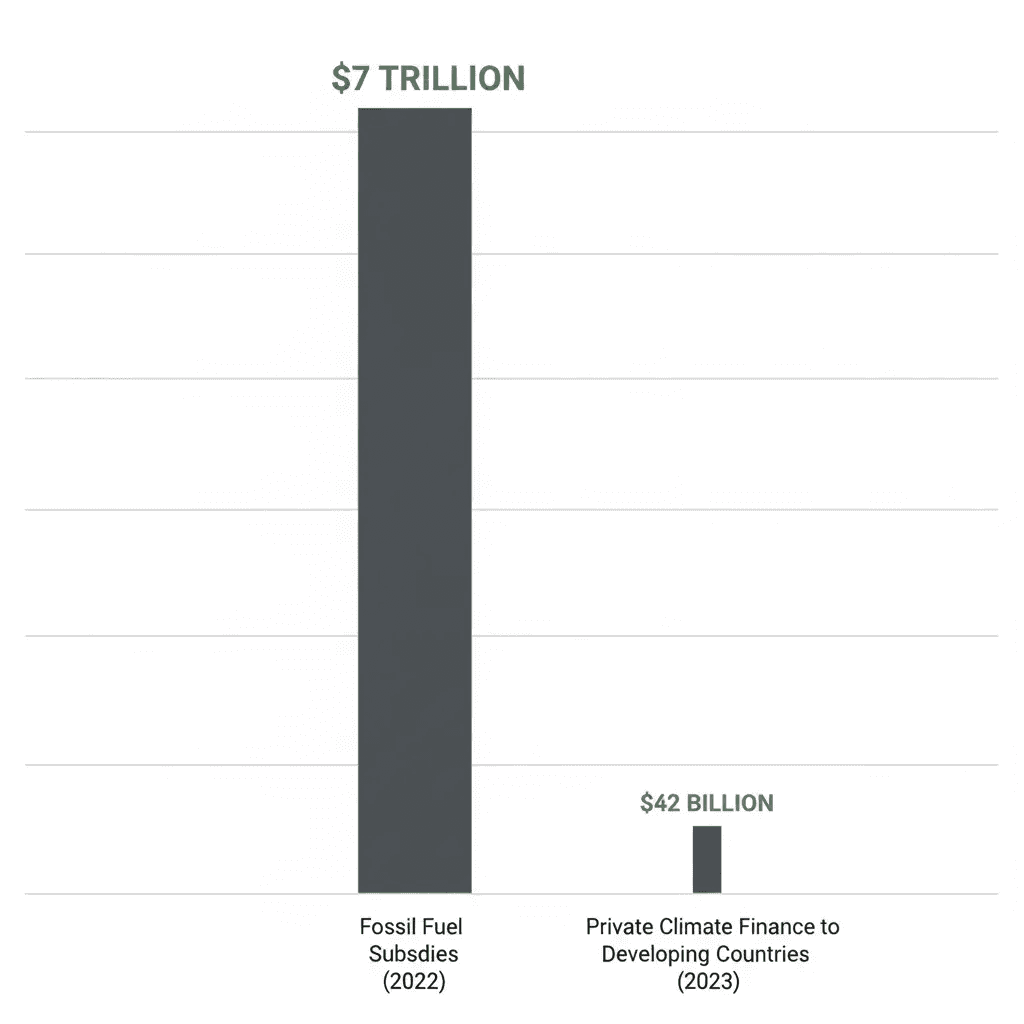

Consider this stark contrast: fossil fuel subsidies totaled $7 trillion in 2022, equivalent to 7.1% of global GDP, while private climate finance flowing to developing countries reached just $42 billion in 2023. The misalignment is glaring. Meanwhile, promising signals emerge: green bond issuance hit $670 billion in 2024, and private climate finance surpassed $1 trillion globally for the first time.

The barriers preventing capital deployment are well-documented: risk perception in emerging markets, limited technical expertise, currency volatility, and inadequate project pipelines. Breaking through requires proven mechanisms that align risk-return profiles with investor requirements.

Proven Pathways Forward

In practice, a small number of proven financing structures have emerged that directly address the risks and constraints holding capital back. The pathways below highlight what is already working and where scale can be accelerated quickly.

Blended Finance strategically combines concessional public capital with commercial investment to improve project economics. The track record is compelling: blended finance transactions achieve average leverage ratios of 4:1—mobilizing four dollars of commercial capital for every public dollar deployed. In climate-specific programs, this ratio can reach 6:1 or higher.

De-risking Mechanisms such as guarantees, insurance, and first-loss capital absorb downside risk, making previously unbankable projects commercially viable. The Africa Energy Guarantee Facility exemplifies this approach, facilitating $1.4 billion in renewable energy investments through structured risk-sharing.

Green Bonds and Sustainable Debt provide standardized instruments that institutional investors understand. India's sustainable debt market demonstrates rapid scaling potential—growing 186% since 2021 to reach $55.9 billion.

Multilateral Development Banks amplify impact through technical assistance, standard-setting, and portfolio-level guarantees. In 2024, MDBs delivered record climate finance of $137 billion while mobilizing $134 billion in private co-investment—a 33% year-over-year increase.

Policy Enablers Matter

Financial engineering alone cannot overcome weak enabling environments. Even well-structured investment vehicles struggle to scale where policy signals are inconsistent, markets lack transparency, or incentives remain misaligned. Carbon pricing at levels that meaningfully drive the transition, elimination of fossil fuel subsidies, clear green taxonomies, and robust disclosure standards create the foundation for private capital deployment, reducing uncertainty and allowing investors to price risk with confidence.

Country platforms that align public policy, domestic finance, and international investment behind coherent transition plans show particular promise for coordinating capital at scale.

The Path Forward

COP29's commitment to mobilize $1.3 trillion annually by 2035 sets the ambition. Achieving it requires coordinated action: financial institutions developing climate investment expertise, governments implementing supportive policies, MDBs maximizing catalytic leverage, and companies developing credible transition plans.

The mechanisms exist. The capital exists. What's required now is systematic deployment—removing barriers, aligning incentives, and channeling trillions toward the largest economic transformation in history.

For investors, climate represents both the defining risk and opportunity of this generation. Those who position capital appropriately will benefit from unprecedented growth. Those who don't face escalating portfolio risks and missed returns.

About Penomo

Penomo is a digital asset infrastructure platform specializing in tokenized energy and AI infrastructure financing.* Through tokenization technology, Penomo is streamlining financing processes, enhancing liquidity, and enabling efficient financing for the global energy transition and AI expansion.

The time to lead is now!

→ Curious if tokenized capital fits your project? Take 2 minutes to find out.

Connect with us: Website | X | Telegram | TG Announcements | Discord | LinkedIn