AI is moving faster than your strategy. Read more

Jan 16, 2026

3

min

The energy transition is increasingly defined not only by marquee projects, but by the “long tail”: thousands (often millions) of smaller, distributed, and highly varied investments - rooftop solar, batteries, building retrofits, small C&I efficiency upgrades, EV charging, and flexible demand solutions. Each ticket may be modest, yet together they can determine whether economies hit reliability, affordability, and decarbonization targets.

So why does this long tail remain underfinanced?

The core challenge: scale without uniformity

Traditional infrastructure finance is optimized for large projects with stable contracts, predictable cash flows, and standardized diligence. The long tail is the opposite: fragmented demand, heterogeneous assets, uneven data quality, and higher transaction costs per dollar deployed.

Ask a practical question: if underwriting a $200 million facility takes a similar committee effort as underwriting a $2 million program, which one gets done faster, and more often?

Why it matters to capital allocators

For many portfolios, the “bankable” part of the transition is already crowded. Meanwhile, the long tail can offer:

Diversification across geographies, counterparties, and technologies (if aggregated intelligently).

Potentially resilient cash-flow profiles when built on large numbers of small payments rather than a single offtaker.

A direct route to measurable real-economy impact, because these assets sit where consumption and emissions actually occur.

A workable financing playbook

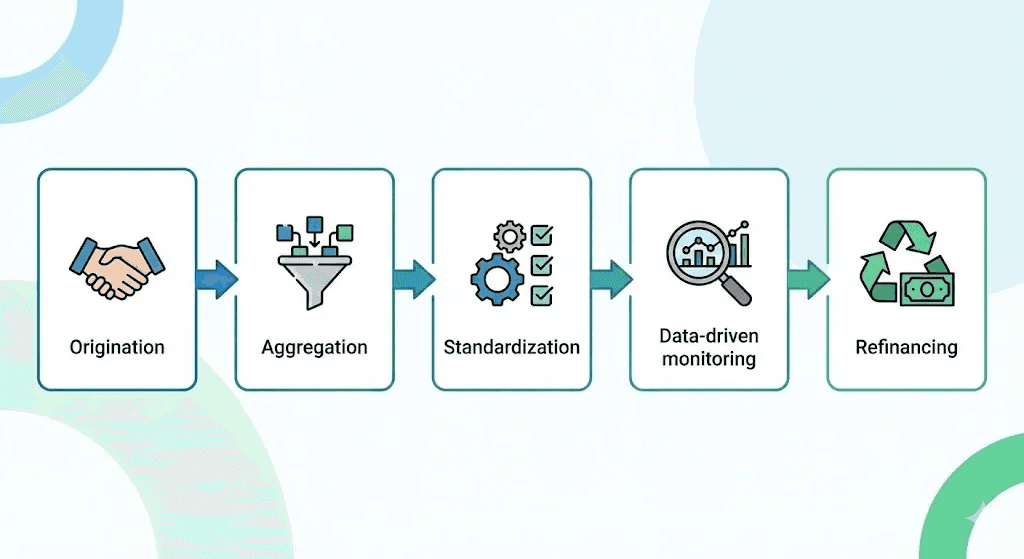

Financing the long tail is less about inventing one new instrument and more about building an efficient system around repeatable origination, underwriting, and monitoring.

Aggregate to create investable size

Pool many small assets into portfolios so the unit economics of diligence and reporting improve.

Standardize what can be standardized

Use repeatable templates for contracts, technical specs, insurance, and performance reporting, then exceptions become the minority, not the rule.

Underwrite with data, not paperwork

Remote monitoring, performance data, and automated checks can reduce information friction and shorten decision cycles.

De-risk strategically

Credit enhancement, guarantees, and blended structures can lower the cost of capital - especially where payback is real but perceived risk remains high.

Global clean energy investment reached about $2 trillion in 2024, underscoring that capital is moving - but the distribution of that capital (and the ability to reach smaller assets efficiently) will shape outcomes.

If the next phase of the energy transition is about deployment at scale, then capital has to become fluent in repetition, not just size. The long tail won’t be unlocked by a single new product; it will be unlocked by building a machine that can originate, bundle, standardize, monitor, and de-risk thousands of smaller assets with the same confidence traditionally reserved for a few large deals. Doing that turns fragmentation into a portfolio feature rather than a constraint, and it’s also where many of the most tangible, measurable outcomes will be delivered.

About Penomo

Penomo is the AI-native operating system for private markets transactions.

We power private credit, private equity, and M&A workflows through modular infrastructure and powerful AI agents built for the real complexity of deal execution - from origination, underwriting and monitoring - designed by operators with deep experience in the space.

Our flagship product CredOS actively operates across Europe and North America enabling lean teams in private credit & infrastructure investment operations to operate at institutional scale. We address the €250B+ annual spend on fragmented, manual layers of private markets that is increasingly converging with the emerging €1T digital asset ecosystem.

→ Get hands-on: Start 7-Day Trial.